Our Home Improvement News Diaries

Wiki Article

All About Home Improvement News

Table of ContentsNot known Incorrect Statements About Home Improvement News The 9-Second Trick For Home Improvement NewsHome Improvement News Things To Know Before You BuyThe Basic Principles Of Home Improvement News

By making your home extra safe, you can in fact make an earnings. The inside of your residence can obtain outdated if you do not make adjustments and update it from time to time. Inside layout styles are always transforming and also what was fashionable five years earlier might look outrageous today.You may even really feel tired after checking out the same setup for several years, so some low-budget changes are always welcome to give you a little modification. You pick to incorporate some traditional aspects that will certainly continue to seem existing as well as elegant throughout time. Do not worry that these renovations will be expensive.

Pro, Suggestion Takeaway: If you really feel that your house is too tiny, you can redesign your cellar to raise the amount of area. You can utilize this as a spare space for your family or you can lease it bent on produce added income. You can take advantage of it by employing professionals that provide redesigning services.

The Single Strategy To Use For Home Improvement News

Home restorations can enhance the method your house looks, but the benefits are extra than that. Read on to find out the advantages of residence renovations.

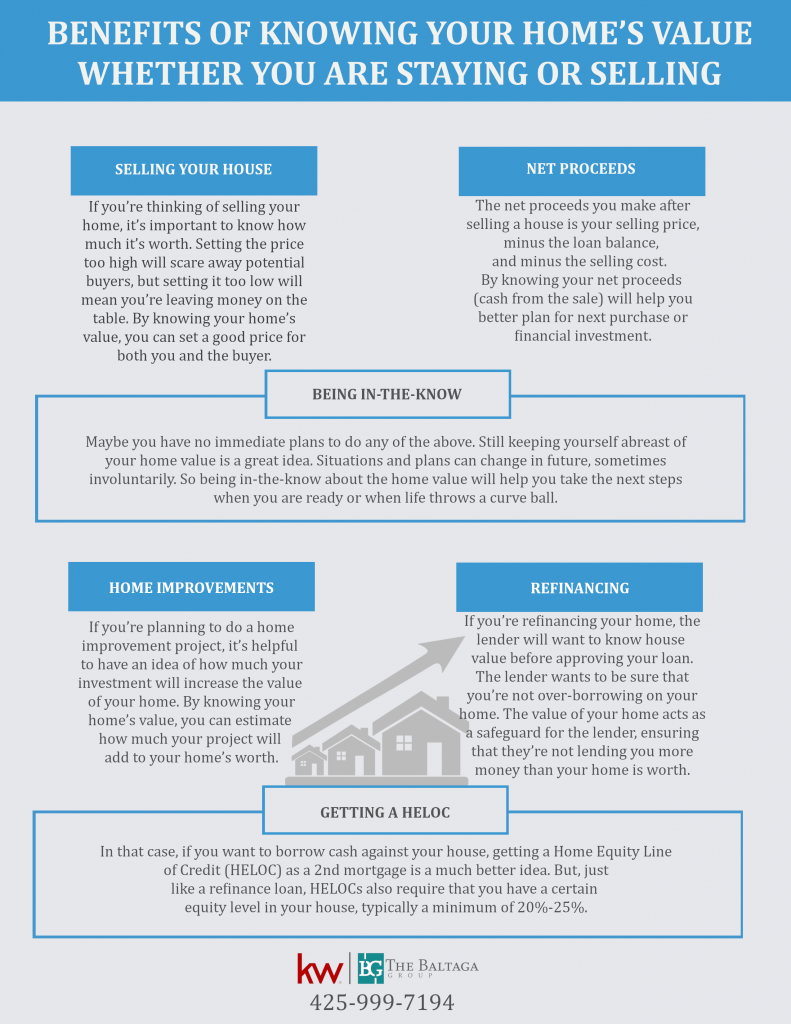

Not only will it look out-of-date, however locations of the home and vital systems can begin to show wear. Routine home repair and maintenance are needed to preserve your residential or commercial property value. A house renovation can aid you preserve and increase that value. Tasks like outside restorations, kitchen remodellings, as well as shower room remodels all have excellent returns on financial investment.

Home equity car loans are preferred among property owners wanting to fund restorations at a reduced rates of interest than various other funding options. The most usual usages for house equity. http://www.askmap.net/location/6640590/united-states/home-improvement-news funding are residence renovation projects and also financial debt loan consolidation. Utilizing a home equity loan to make residence enhancements includes a couple of benefits that various other uses don't.

How Home Improvement News can Save You Time, Stress, and Money.

That fixed rate of interest implies your month-to-month payment will certainly be constant over the regard to your lending. In a climbing rate of interest atmosphere, it might be simpler to factor a fixed repayment right into your spending plan. The other choice when it involves tapping your residence's equity is a residence equity line of credit rating, or HELOC.You'll just pay passion on the cash you have actually borrowed during the draw duration, yet, usually at a variable rate. That indicates your monthly repayment goes through alter as prices climb. Both home equity finances and also HELOCs utilize your residence as security to secure the finance. If you can not manage your month-to-month settlements, you could shed your house-- this is the biggest risk when borrowing with either type of loan.

Take into consideration not just what you want right now, yet what will appeal to future buyers since the jobs you select will affect the resale value of your residence. Work with an accounting professional to make certain your interest is effectively deducted from your taxes, as it can conserve you 10s of thousands of dollars over the life of the lending (deck staining).

Home Improvement News Things To Know Before You Get This

Present residence equity rates are as high as 8. 00%, however individual fundings are at 10., such as the one we're in today.Additionally as pointed out over, it matters what type of improvement projects you carry out, as specific residence enhancements offer a higher return on investment than others. A minor cooking area remodel will certainly redeem 86% of its worth when you market a residence compared with 52% for a wood deck enhancement, according to 2023 data from Renovating magazine that analyzes the expense of remodeling projects.

While building worths have actually escalated over the last 2 years, if residence costs drop for any factor in your area, your investment in improvements won't have in fact raised your home's value. When you end up owing more on your mortgage than what your residence is in fact worth, it's called negative equity or being "underwater" on your home mortgage.

A HELOC is typically better when you desire a lot more adaptability with your financing. With a fixed-interest rate you do not need to stress over your payments rising or paying a lot more in you could try these out interest with time. Your regular monthly payment will constantly coincide, whatever's occurring in the economy. All of the cash money from the lending is dispersed to you upfront in one repayment, so you have accessibility to all of your funds right away.

Report this wiki page